When it comes to jet-setting across the United States, having the right premium travel credit card can make all the difference. From exclusive perks to luxury benefits, these cards are designed to elevate your travel experience. In this comprehensive guide, we delve into the intricacies of premium travel credit cards, helping you make an informed decision on the best one for your needs.

The Platinum Standard: Unveiling the Top Contenders

American Express Platinum Card

Known for its prestigious status, the American Express Platinum Card stands as a symbol of opulence and sophistication in the credit card world. With premium benefits like airport lounge access, travel credits, and concierge services, it caters to the discerning traveler seeking a seamless journey.

Chase Sapphire Reserve

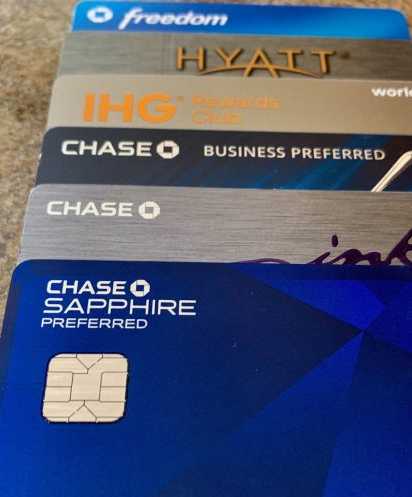

Chase Sapphire Reserve has secured its spot as a formidable player in the premium credit card arena. Boasting a generous rewards program and a substantial sign-up bonus, it’s a favorite among frequent flyers. The Priority Pass membership and travel insurance further add to its allure.

Citi Prestige Card

Citi Prestige Card enters the fray with a unique set of features, including complimentary hotel nights and a 4th-night free benefit. With a diverse range of travel partners, it offers flexibility in redeeming points, making it a contender worth considering.

Decoding the Criteria: What Makes a Premium Travel Credit Card Stand Out?

Rewards Program

The heart of any premium travel credit card lies in its rewards program. From earning points on every purchase to exclusive bonus categories, a robust rewards system can significantly enhance your travel aspirations. The American Express Platinum Card, for instance, excels in offering Membership Rewards, providing flexibility in redeeming points for flights, hotels, or even merchandise.

Travel Perks

When choosing a premium travel credit card, one must pay close attention to the array of travel perks offered. Priority boarding, airport lounge access, and TSA PreCheck reimbursement are among the sought-after benefits. Chase Sapphire Reserve takes the lead here, offering a comprehensive suite of travel privileges that redefine the travel experience.

Annual Fees vs. Benefits

While annual fees can be a deterrent, they often come with a slew of benefits that outweigh the cost. Citi Prestige Card, though carrying a higher annual fee, counters it with exclusive perks like complimentary hotel nights and a valuable 4th-night free benefit. Understanding this balance is crucial in identifying the true value a premium travel credit card brings to the table.

Making the Decision: Which Premium Travel Credit Card Is Right for You?

Choosing the best premium travel credit card boils down to your individual preferences and travel habits. If you prioritize luxury travel and exclusive experiences, the American Express Platinum Card might be the perfect fit. For those seeking a well-rounded card with a competitive rewards program, the Chase Sapphire Reserve could be the answer. Citi Prestige Card, on the other hand, appeals to those who value complimentary hotel stays and unique travel perks.

Read More: Which chase credit card is best?

Easiest travel credit cards to get approved

Capital One Venture Rewards Credit Card: This card offers a generous welcome bonus of 75,000 miles after spending $4,000 on purchases in the first 3 months from account opening. It also has a $95 annual fee, waived the first year. While Capital One doesn’t publicly state its credit score requirement, it’s generally considered easier to get approved for than many other travel cards, often targeting applicants with scores in the good (670-739) range.

Chase Freedom Unlimited®: This card has no annual fee and offers a flat 1.5x points on all purchases. It’s a good option for those with limited credit history or lower scores (around 670 or higher) looking to build credit and earn travel rewards.

Discover it® Miles: This card also has no annual fee and offers a decent 1.5x miles on all purchases. Discover is known for being a good option for first-time cardholders or those rebuilding their credit. They typically target applicants with scores in the fair (580-669) range.

Secured cards: These cards require a refundable security deposit, which becomes your credit limit. Using the card responsibly and making payments on time can help you build your credit score and eventually qualify for an unsecured travel card. Some popular options include the Capital One Quicksilver Secured Card and the Discover it® Secured Card.

Conclusion

In the realm of premium travel credit cards, the competition is fierce, each card vying for the top spot. As you embark on your quest for the best premium travel credit card, consider your priorities, whether it be luxury benefits, travel rewards, or exclusive perks. With the right card in hand, your journeys across the United States will undoubtedly be elevated to new heights.